The challenger bank Revolut launched in 2015, originally bringing their prepaid card to market that aimed to remove fees and serve its users better than banks were. They have since transformed into a fully fledged digital bank. Now worth a staggering $5.5bn, is this neo-bank still looking after their customers?

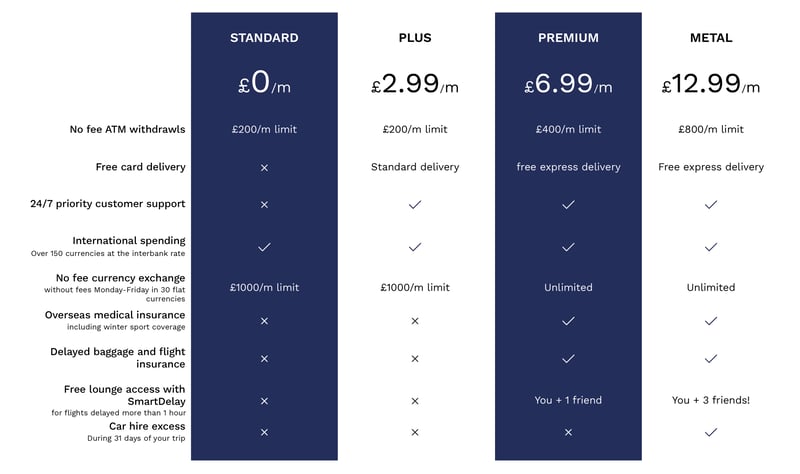

Revolut currently offer four subscription plans including the standard card which is a free subscription all the way to their metal subscription which is set at £12.99/m.

Each plan comes with a range of travel spending perks including unlimited spending in 30 currencies and free lounge access when your flight is delayed at the premium plan.

*Rates and charges shown are correct as of 5th May 2021

It’s well known that High-Street banks often apply hidden charges, even when ‘zero fee’ exchange rates were advertised the fees were often hidden in the extra rate. However, with limited options on the market, other than expensive travel Bureau de Change providers, a number of consumers swallowed the charges.

Revolut pioneered the travel money card market offering a new solution to consumers that allowed them to preload their account and convert to 150 currencies, reducing a number of these hidden charges.

By challenging the charges applied by the banks, consumers became more informed and empowered in their ability to choose new solutions. But even with a new choice on the market, a number of consumers still choose to swallow the bank fees and use their existing debit card to avoid the hassle of managing a separate account when they’re abroad.

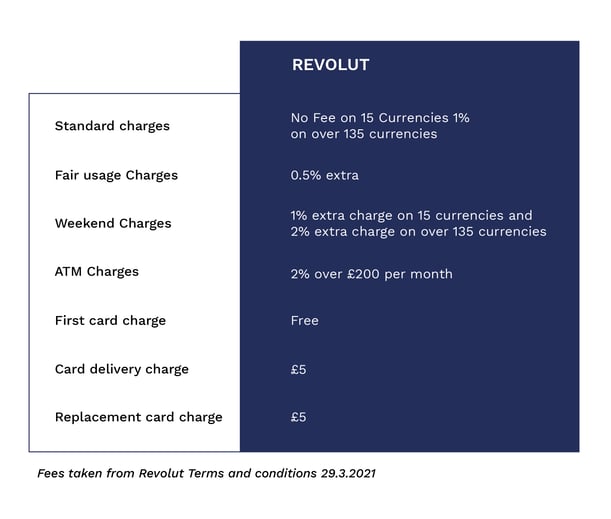

Revolut offers over 150 currencies at the real exchange rate, but there are some hidden fees you need to be aware of. We can see in the T&C’s that only the 15 most common currencies are actually available at the interbank rate rather than the 150 that they state.

There was some confusion over which currencies are considered as a “less traded money currency” as only THB and UAH are listed, but when we spoke to their customer service team (on 27/06/2020), they confirmed that all currencies other than the listed 15 are not available at the real rate and instead incur a fee – when we looked at the exchange rates for other currencies, they were away from interbank but not quite as expensive as the 1% added to THB and UAH.

Currensea's travel debit card partners directly with your existing bank account, so you can spend with confidence and without the need to top-up or pre-load.

By partnering with your existing bank account you can spend in all 180 currencies just as you would your normal debit card, but without the fees.

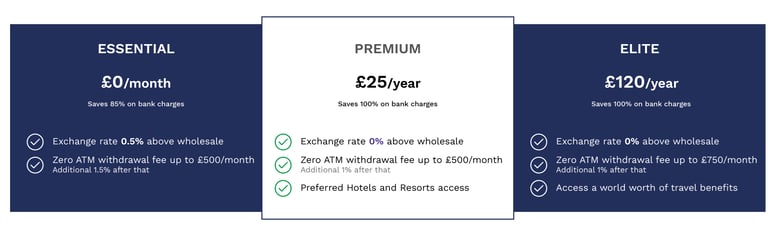

Currensea currently offers three pricing plans, an Essential plan, a Premium plan priced at £25 per year, and an Elite plan priced at £120 per year. Access the best rates at only 0.5% above the FX base rate on our Essential plan, saving you at least 85% on every transaction, or 0% on our Premium and Elite plans, saving you 100% on every transaction. Elite also provides cardholders with access to a world worth of benefits including concierge and LoungeKey access.

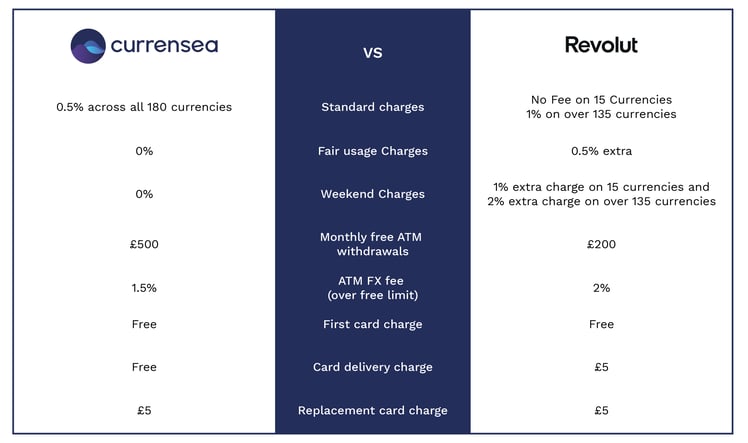

Currensea offers 15 currencies at the real (interbank) rate and 165 currencies at the Mastercard rate. When signing up for the free plan, users will be charged at a flat FX rate of 0.5% over these two base rates – with no extra charges over a certain amount or at weekends, it’s that simple.

There is also a 0.5% charge if you spend over £1,000 per month, in accordance with their fair usage policy. Worst case scenario if you spend over £1,000 in THB at the weekend, your fees could skyrocket to 3.5%, which is more than the charges applied by some high-street banks.

Currensea does not have any such fees for using their travel debit card. You have your set monthly limits, but anything you spend is at the same rate of 0.5%

Suppose you're going on a typical week abroad in Europe and spend over £1,000. In that case, Currensea is likely to be the cost-effective method of choice since Revolut charges 1% in fees on weekends (typically when people check-out of their hotels), and an extra 0.5% fair usage over £1000. Revolut is an excellent choice if you're going away on weekdays only in Europe (with a budget under £1,000).

Alternatively, if you are planning a trip to South Africa for a week, even if you spend less than £1,000 during your trip and make exchanges during the week rather than at the weekend – Currensea would still be the cheapest option as we add a 0.5% fee on top of the interbank exchange rate, whereas Revolut adds 1% during the week for all spend and an extra 2% at the weekend.

Currensea Limited is registered in England and Wales (No. 11413946), authorised by the Financial Conduct Authority (Reference No. 843507) and is a Principal Member of Mastercard. We are registered with the Information Commissioner's Office (Registration No. ZA524676).

© Currensea Limited 2022